Navigating the Jumbo Financing Landscape: Important Insights for First-Time Homebuyers

Navigating the complexities of jumbo lendings offers an one-of-a-kind set of challenges for newbie property buyers, particularly in a progressing property market. Recognizing the vital eligibility demands and prospective advantages, together with the drawbacks, is important for making educated decisions. Additionally, establishing a solid financial technique can significantly enhance your prospects. Involving with professionals in the field can illuminate pathways that may originally appear discouraging. As you check out these details, it comes to be clear that a deeper understanding can disclose chances that could otherwise be forgotten. How can you finest position yourself for success in this specialized sector of lending?

Recognizing Jumbo Car Loans

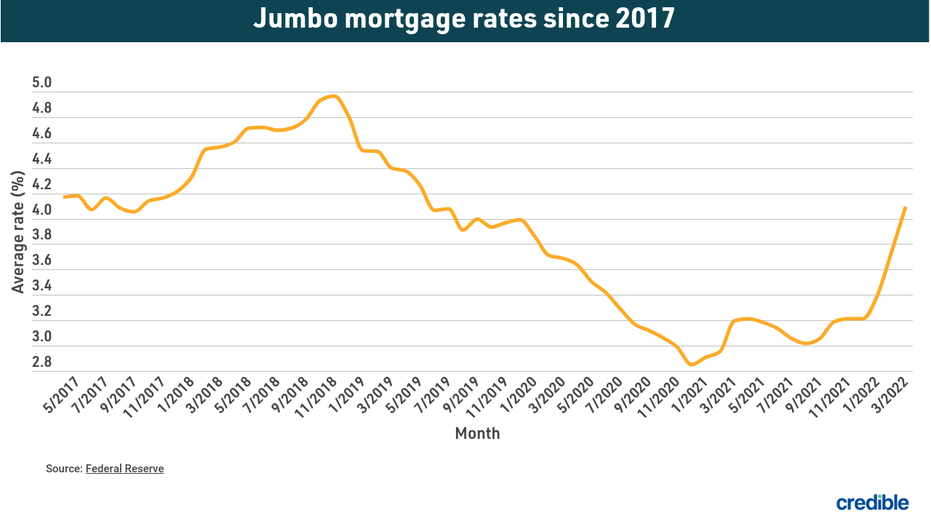

Since big financings are not backed by government-sponsored entities, they bring different underwriting criteria and need more thorough economic paperwork. This distinction can bring about greater rate of interest compared to conventional lendings, provided the enhanced danger to lenders. However, big financings likewise offer unique benefits, such as the ability to fund higher-value residential properties and potentially much more adaptable terms.

New buyers need to likewise understand that protecting a big lending often necessitates a bigger deposit, typically varying from 10% to 20%. Furthermore, customers are usually anticipated to demonstrate solid creditworthiness and a stable income to certify. Understanding these nuances can encourage new buyers to make educated decisions when discovering jumbo finance alternatives in their search of homeownership.

Eligibility Requirements

Safeguarding a jumbo loan needs meeting details eligibility requirements that vary significantly from those of conventional finances. Unlike conventional fundings, which are often backed by government-sponsored entities, jumbo lendings are not guaranteed or guaranteed, resulting in stricter standards.

In addition, customers must show a durable monetary account, which consists of a low debt-to-income (DTI) ratio, normally no greater than 43%. This ensures that customers can manage their regular monthly repayments together with various other monetary obligations.

Furthermore, most loan providers need substantial documents, including evidence of revenue, property statements, and tax obligation returns for the past 2 years. A significant deposit is additionally crucial; while standard fundings may permit deposits as low as 3%, jumbo loans often require at least 20%, depending upon the loan provider and the lending amount.

Advantages of Jumbo Car Loans

For numerous first-time buyers, big lendings supply distinctive advantages that can help with the trip toward homeownership. One of the primary advantages is the capacity to finance buildings that surpass the adapting car loan limitations set by government-sponsored entities. This adaptability enables customers to access a bigger series of high-value properties in affordable realty markets.

In addition, jumbo finances commonly include attractive rate of interest that can be reduced than those of typical finances, particularly for customers with strong credit report profiles. This can result in Visit This Link significant savings over the life of the loan, making homeownership a lot more inexpensive. Jumbo loans usually enable for higher finance quantities without the need for exclusive mortgage insurance coverage (PMI), which can further minimize month-to-month repayments and general costs.

Potential Drawbacks

Many prospective property buyers may discover that jumbo finances included considerable drawbacks that call for mindful consideration. One of the main concerns is the strict credentials criteria. Unlike conforming car loans, big loans typically call for higher credit rating ratings, commonly exceeding 700, and significant revenue documentation, making them much less accessible for some consumers.

Furthermore, jumbo finances normally feature greater rate of interest contrasted to standard finances, which can bring about raised regular monthly settlements and overall loaning prices. This premium may be particularly challenging for new buyers that are currently browsing the monetary intricacies of purchasing a home.

An additional noteworthy disadvantage is the larger down payment need. Lots of lenders anticipate a minimum deposit of 20% or even more, which can pose an obstacle for purchasers with restricted financial savings. Moreover, the lack of government support for big fundings results in less positive terms and problems, increasing the threat for loan providers and, consequently, the loaning costs for house owners.

Finally, market variations can substantially impact the resale value of high-end buildings funded with big lendings, adding a component of financial changability that new buyers might locate daunting.

Tips for First-Time Homebuyers

Navigating the complexities of the homebuying procedure can be frustrating for first-time customers, especially when thinking about big loans (jumbo loan). To streamline this trip, adhering to some crucial techniques can make a significant difference

First, inform on your own on big finances and their particular demands. Understand the different financing standards, consisting of credit history, debt-to-income ratios, and down repayment assumptions. Normally, a minimum credit report rating of 700 her response and a down settlement of at least 20% are essential for authorization.

2nd, involve with a knowledgeable mortgage professional. They can supply insights customized to your financial circumstance and aid you browse the complexities of the jumbo lending landscape.

Third, consider check my site pre-approval to strengthen your buying setting. A pre-approval letter signals to vendors that you are a significant customer, which can be beneficial in open markets.

Lastly, do not overlook the importance of budgeting. Element in all expenses related to homeownership, including home tax obligations, maintenance, and homeowners' insurance. By adhering to these pointers, novice customers can approach the big loan process with higher confidence and clearness, boosting their opportunities of successful homeownership.

Final Thought

Finally, browsing the jumbo finance landscape calls for a thorough understanding of eligibility requirements, advantages, and potential drawbacks. First-time buyers can improve their possibilities of success by preserving a solid credit history, managing their debt-to-income ratio, and planning for larger deposits. Engaging with experienced home mortgage experts and obtaining pre-approval can better reinforce placements in competitive markets. Eventually, complete preparation and education and learning pertaining to big car loans can result in more informed decision-making in the homebuying procedure.

When browsing the intricacies of the real estate market, understanding jumbo car loans is important for novice property buyers intending for buildings that exceed standard financing restrictions. Jumbo lendings are non-conforming loans that normally exceed the adhering lending restriction set by the Federal Real Estate Money Agency (FHFA)In addition, jumbo finances typically come with attractive rate of interest rates that can be lower than those of standard fundings, specifically for consumers with solid credit score accounts. Jumbo loans generally permit for greater funding quantities without the requirement for private mortgage insurance (PMI), which can further minimize regular monthly settlements and overall prices.

Unlike conforming lendings, jumbo lendings normally need greater credit report scores, usually surpassing 700, and considerable revenue documents, making them less easily accessible for some debtors.

Comments on “Is a Jumbo Loan Right for You? Discover the Advantages and Needs”